Proof Of Debt Letter

How To Use A Proof of Debt or Ownership Request Letter

Purpose:

A Proof of Debt or Ownership Request Letter goes deeper than a validation letter — it asks the collector to show exactly how the debt was transferred, sold, or assigned to them. It’s designed to confirm the chain of custody from the original creditor to the current collector. When to Use:

Many debt buyers purchase old or inaccurate accounts in bulk. By requesting a proof of ownership, you ensure that:

If they can’t produce these documents, the debt may be uncollectible or unenforceable. Always keep written records in case the account resurfaces later.

A Proof of Debt or Ownership Request Letter goes deeper than a validation letter — it asks the collector to show exactly how the debt was transferred, sold, or assigned to them. It’s designed to confirm the chain of custody from the original creditor to the current collector. When to Use:

- You have already received a validation response, but the debt has been sold or transferred multiple times.

- The collector claims to own the debt, but provides limited proof.

- You want to ensure they have a legal right to collect or sue for it.

Many debt buyers purchase old or inaccurate accounts in bulk. By requesting a proof of ownership, you ensure that:

- The collector legally acquired your specific account.

- The balance they claim matches the verified amount.

- No errors or duplications occurred during the transfer.

- A copy of the original signed contract or account agreement.

- Full chain of assignment from the original creditor to the current agency.

- Itemized payment history and charge-off documentation.

If they can’t produce these documents, the debt may be uncollectible or unenforceable. Always keep written records in case the account resurfaces later.

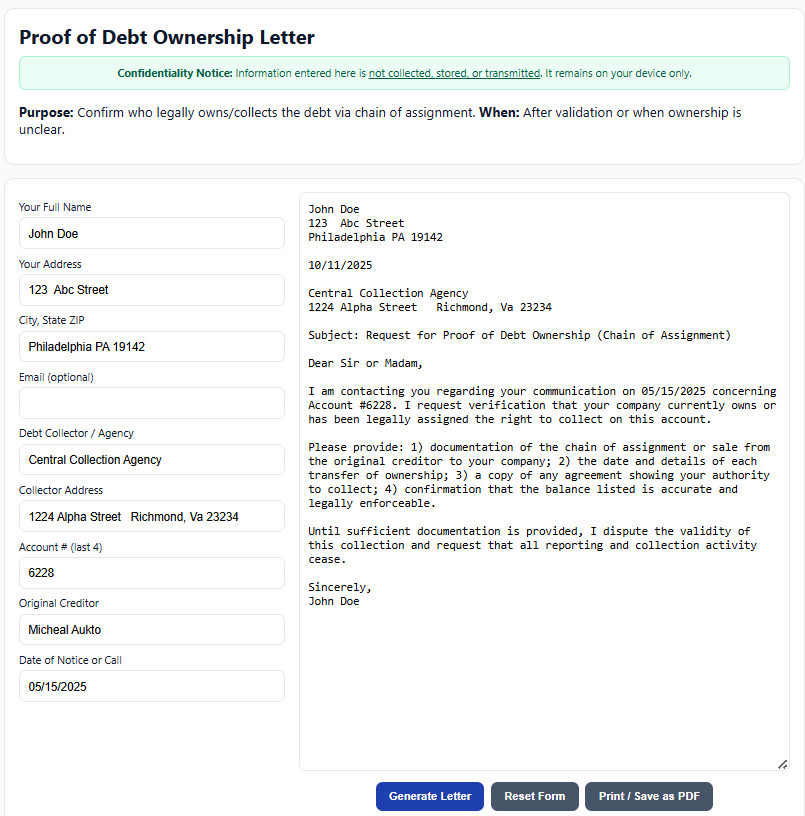

How To Us The Form Generator

See the example of the form below. Fill in your details of the form. Once you have completed, select the Generate Letter button, and your form will appear in the panel. Print or Save as PDF