Goodwill Adjustment

How To Use Goodwill Adjustment Letter

Purpose:

A Goodwill Adjustment Letter politely asks a creditor to remove or re-code a legitimate negative mark (usually a late payment) as a courtesy based on your overall positive history or a temporary hardship that’s been resolved. It’s not a dispute of accuracy—it’s a request for leniency. When to Use:

Even a single recent late payment can significantly lower your credit score and affect approvals or rates. A granted goodwill adjustment can improve your report and scores by removing or changing the late mark (e.g., from “30 days late” to “current”). How the Process Works:

Keep it short and positive (¾ page or less). Emphasize your overall on-time history, that the issue was temporary, and the preventive steps you’ve taken (autopay, alerts). If declined, maintain perfect payments for a few months and try again—a different reviewer or stronger recent history can change the outcome.

A Goodwill Adjustment Letter politely asks a creditor to remove or re-code a legitimate negative mark (usually a late payment) as a courtesy based on your overall positive history or a temporary hardship that’s been resolved. It’s not a dispute of accuracy—it’s a request for leniency. When to Use:

- You have one or a few isolated late payments with otherwise strong on-time history.

- A temporary hardship (job loss, medical issue, move, billing mix-up) caused the lapse and is now resolved.

- The account is current (or closed in good standing) and you’ve taken steps to prevent future issues (e.g., autopay).

- You are a longstanding customer or have multiple products with the lender.

Even a single recent late payment can significantly lower your credit score and affect approvals or rates. A granted goodwill adjustment can improve your report and scores by removing or changing the late mark (e.g., from “30 days late” to “current”). How the Process Works:

- Identify the exact late entry (month/year, status) you’re asking to be adjusted.

- Prepare context: brief explanation of the temporary hardship and what has changed; gather any simple proof if available.

- Write a concise, respectful letter acknowledging the late was accurate and requesting a one-time goodwill adjustment.

- Send it to the creditor’s credit reporting/servicing team (secure message, mail, or designated address).

- Follow up in 2–4 weeks if you don’t receive a response.

- Monitor your credit reports; approved adjustments usually appear within the next reporting cycle.

Keep it short and positive (¾ page or less). Emphasize your overall on-time history, that the issue was temporary, and the preventive steps you’ve taken (autopay, alerts). If declined, maintain perfect payments for a few months and try again—a different reviewer or stronger recent history can change the outcome.

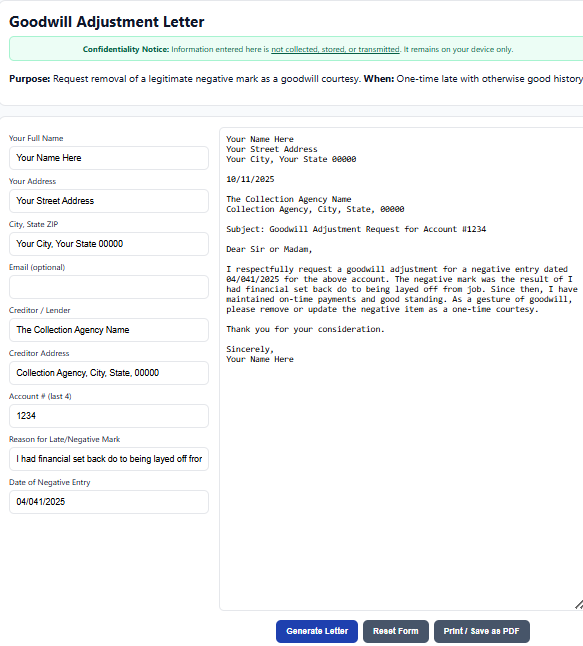

How To Use Form Generator

See the example of the form generator. Fill in your details on the left panel of the form. Once you have completed, select the Generate Letter button, and your form will appear in the right side panel. Print or Save your form as a PDF.8