Debt Settlement

How To Use the Debt Settlement Offer Letter

Purpose:

This letter proposes to settle a debt for less than the full balance owed. It outlines your offer and requests written confirmation before any payment is made. When to Use:

A debt settlement can help you clear old accounts and move forward financially. However, it must be handled carefully — only pay after receiving written acceptance that the payment will settle the account in full. Tip:

Negotiate professionally. Many collectors will accept 40%–60% of the balance as full payment. Always request confirmation that the account will be marked “Paid in Full” or “Settled” on your credit report.

This letter proposes to settle a debt for less than the full balance owed. It outlines your offer and requests written confirmation before any payment is made. When to Use:

- You owe more than you can afford to pay in full.

- The account is already charged off or in collections.

- You want to resolve the debt and move toward rebuilding credit.

A debt settlement can help you clear old accounts and move forward financially. However, it must be handled carefully — only pay after receiving written acceptance that the payment will settle the account in full. Tip:

Negotiate professionally. Many collectors will accept 40%–60% of the balance as full payment. Always request confirmation that the account will be marked “Paid in Full” or “Settled” on your credit report.

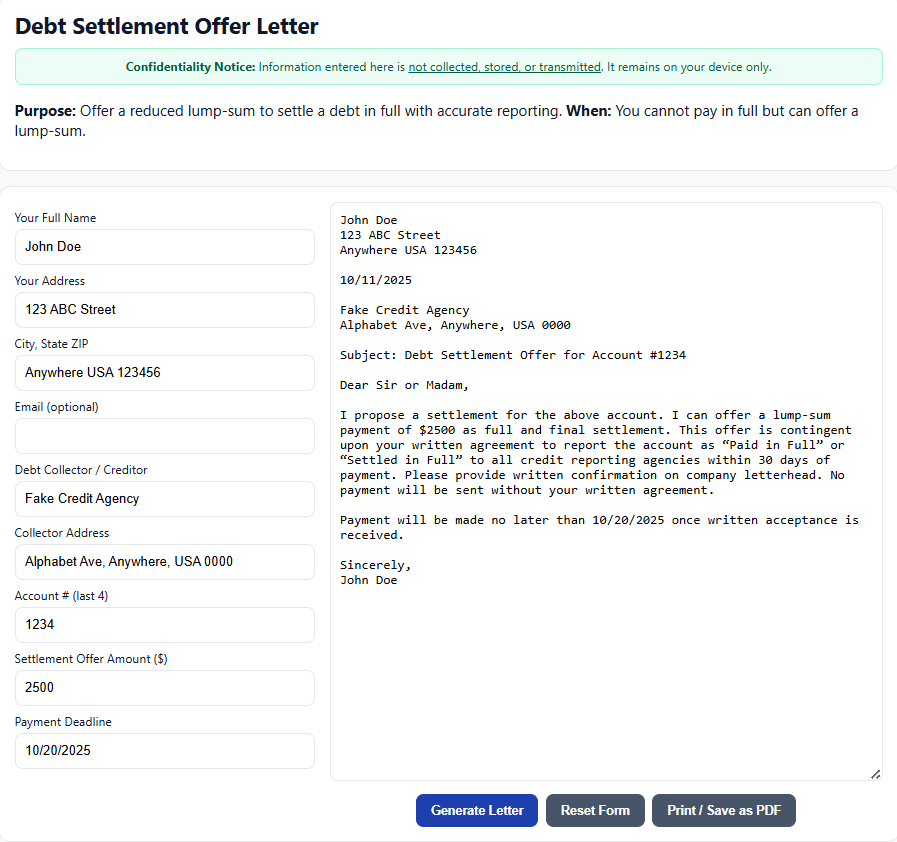

How To Use Form Generator

See the example of the form generator. Fill in your details on the left panel of the form. Once you have completed, select the Generate Letter button, and your form will appear in the right side panel. Print or Save your form as a PDF.8