Credit Dispute Letter

How To Use Debit Dispute Letter

Purpose:

A Debt Dispute Letter challenges inaccurate, incomplete, or unverifiable information listed on your credit report. Under the Fair Credit Reporting Act (FCRA, 15 U.S.C. §1681i), the credit bureaus must investigate and respond within 30 days of receiving your dispute. When to Use:

Inaccurate information can lower your credit score and prevent loan approvals. By filing a dispute, you trigger a legal obligation for the bureaus to verify the information with the furnisher (the creditor or collector). If they cannot verify it, the item must be corrected or removed. How the Process Works:

Include a copy of your credit report with the disputed items clearly highlighted, plus proof of ID and address. Always dispute one issue per letter for clarity and better results.

A Debt Dispute Letter challenges inaccurate, incomplete, or unverifiable information listed on your credit report. Under the Fair Credit Reporting Act (FCRA, 15 U.S.C. §1681i), the credit bureaus must investigate and respond within 30 days of receiving your dispute. When to Use:

- You notice incorrect account balances, duplicate listings, or unfamiliar collections.

- You’ve received proof that a debt is invalid or outdated.

- You want to ensure your credit report reflects accurate information.

Inaccurate information can lower your credit score and prevent loan approvals. By filing a dispute, you trigger a legal obligation for the bureaus to verify the information with the furnisher (the creditor or collector). If they cannot verify it, the item must be corrected or removed. How the Process Works:

- You send the dispute letter (online or by mail) explaining what’s wrong and providing supporting documentation.

- The bureau forwards your dispute to the data furnisher.

- The furnisher must investigate and respond within 30 days.

- The bureau must update, correct, or delete the entry if it can’t be verified.

Include a copy of your credit report with the disputed items clearly highlighted, plus proof of ID and address. Always dispute one issue per letter for clarity and better results.

How To Use Form Generator

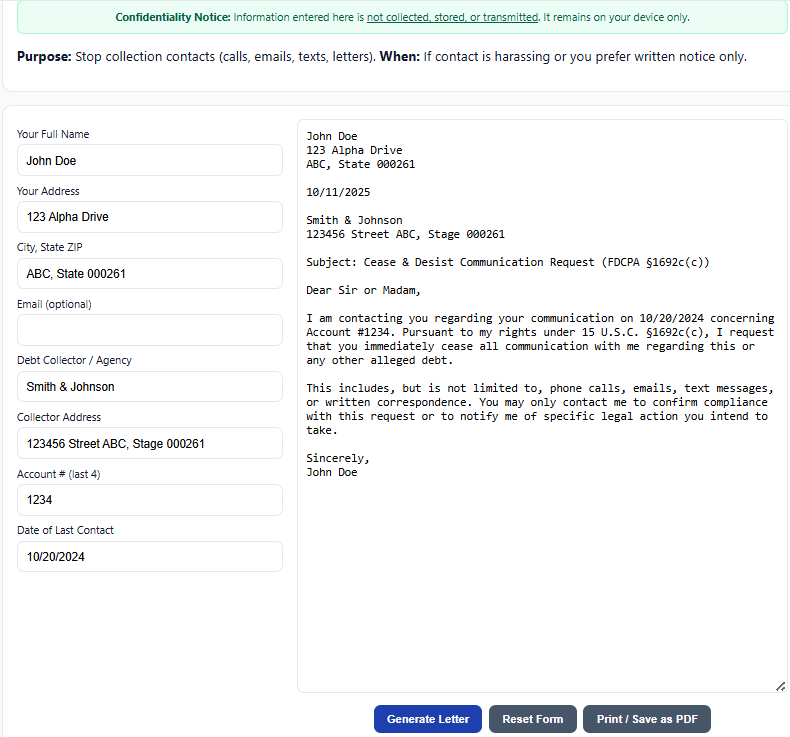

See the example of the form generator. Fill in your details on the left panel of the form. Once you have completed, select the Generate Letter button, and your form will appear in the right side panel. Print or Save your form as a PDF.